Marketing directors and email marketing specialists at financial advisory firms often face a familiar challenge: engaging leads and converting them into clients. While crafting personalized, engaging emails is the first step, tracking effectiveness and knowing which emails lead to conversions can be elusive.

With 80% of new business leads never converting due to slow follow-ups or ineffective communication, this article will provide 10 proven email marketing strategies that will help you nurture leads and move them through your funnel. You’ll also get actionable tips and free email templates to help you get started.

By leveraging these strategies and using tools like LeadCenter, you can automate, optimize, and track every step of your email campaigns, ensuring your firm engages prospects at the right moment and converts them into clients.

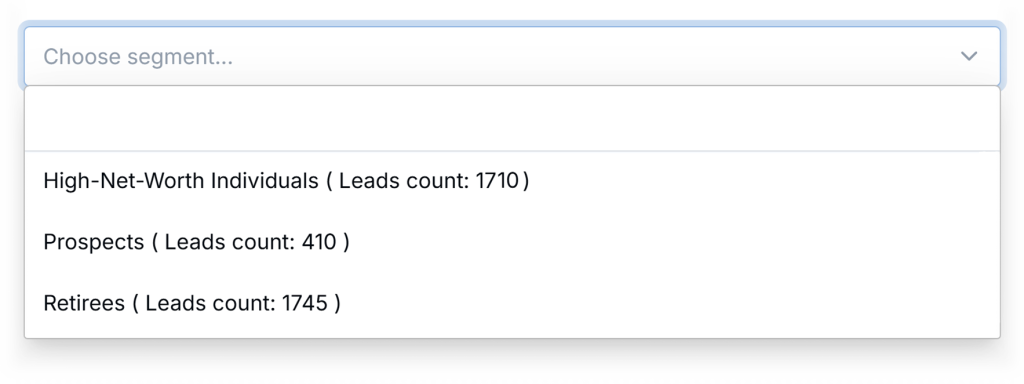

Segmenting your email list based on client interests, financial goals, or demographics can increase revenue by up to 760%. Personalized emails that speak directly to the unique needs of each prospect are far more effective than generic messages sent to everyone.

With tools like LeadCenter, you can create filters based on contact fields, tags, and other data points to deliver personalized emails at the right time. Use personalization shortcodes to dynamically insert client names, financial goals, or investment interests.

Subject: Secure Your Financial Future: Personalized Retirement Planning with [Your Firm]

Body:

Hi [First Name],

Are you prepared for retirement? Many people feel uncertain about their financial future, but with the right plan, you can approach retirement with confidence. At [Your Firm], we specialize in helping individuals like you develop tailored retirement strategies that ensure financial security.

Here’s what we can help you with:

Let’s schedule a complimentary, no-obligation consultation to discuss your retirement goals and how we can help you achieve them.

[Schedule Your Complimentary Consultation]

More than 60% of emails are now opened on mobile devices. If your emails aren’t optimized for mobile, you risk losing engagement and conversion opportunities. Emails that are difficult to read on smaller screens or load too slowly can easily lead to a prospect losing interest.

With LeadCenter, you can preview your emails on different devices to ensure they are responsive and mobile-friendly. This ensures that whether your leads open your email on their phones or desktops, they’ll have a seamless experience.

Sending too many emails can overwhelm prospects, leading to higher unsubscribe rates. On the other hand, sending too few emails may cause your firm to fall off their radar. Finding the right balance of frequency ensures you stay top-of-mind without annoying your audience.

With LeadCenter, you can track email engagement metrics and adjust your email frequency accordingly. If you notice a drop in engagement, you can lower your frequency or adjust the content to better fit your audience’s needs.

Subject: [First Name], Maximize Your Wealth with a Personalized Investment Strategy

Body:

Hi [First Name],

At [Your Firm], we know that high-net-worth individuals like you have unique financial needs. Whether you’re looking to grow your wealth, preserve your assets, or build a legacy, having a customized investment strategy is critical to success.

Here’s how we can help you:

Let’s schedule a time to discuss how we can help you grow your wealth and secure your financial future.

[Schedule Your Complimentary Consultation Here]

It takes an average of 7 to 10 touchpoints to convert a lead into a client. A well-planned email sequence allows you to nurture leads gradually by sending scheduled emails over time. These sequences help keep your firm top-of-mind while offering valuable insights and resources at regular intervals.

LeadCenter’s email campaigns feature makes it easy to set up a sequence of emails that are sent over time, ensuring that your prospects receive the right content at the right stage of their journey. You can customize the timing of each email to keep leads engaged without overwhelming them.

Email Sequence #1:

Subject: Optimize Your Investments and Minimize Taxes with [Your Firm]

Body:

Hi [First Name],

One of the most overlooked aspects of wealth-building is tax-efficient investing. At [Your Firm], we specialize in helping clients like you minimize tax liabilities while optimizing your investment strategy for long-term growth.

Let’s set up a time to discuss how we can help you build a tax-efficient investment plan that keeps more of your hard-earned money in your pocket.

[Schedule Your Consultation Here]

Email Sequence #2:

Subject: [First Name], Are You on Track to Achieve Your Financial Goals?

Body:

Hi [First Name],

At [Your Firm], we believe in the power of consistent check-ins to ensure your financial plan evolves as your life changes.

Let’s schedule a quick check-in call to review your financial strategy and discuss any adjustments that may be needed.

[Schedule a Quick Check-In Here]

Your subject line is the first impression your email makes. A compelling subject line can be the difference between an email being opened or ignored. Paired with optimal send times, you can maximize engagement with each email campaign.

With LeadCenter, you can track open rates and run A/B tests on different subject lines to see which ones perform best. You can also schedule emails to be sent at optimal times for your audience, ensuring higher open rates.

Your call to action (CTA) is what drives the lead to take the next step. Whether it’s scheduling a consultation, downloading a guide, or attending a webinar, your CTA should be clear and direct.

Whether you’re driving prospects to book a consultation or attend a webinar, make sure your CTA is clear and actionable. Tools like LeadCenter’s BookMyTime make it easy for clients to schedule time directly on your calendar.

Also, LeadCenter’s analytics help you track CTA performance, showing which buttons or links drive the most clicks. This data allows you to refine your CTAs and improve their effectiveness over time.

Subject: Don’t Wait to Plan for Your Future, [First Name]

Body:

Hi [First Name],

The sooner you start planning for your financial future, the better positioned you’ll be to reach your goals. Every year you delay is a missed opportunity to take full advantage of compounding returns and tax-efficient strategies that could secure your future.

Let’s schedule a time to discuss how we can help you build a financial strategy that supports your long-term goals.

[Book a Complimentary Consultation]

Research shows that 78% of leads convert with the first company that responds to their inquiry. Automated follow-ups ensure that your firm is the first to respond, increasing your chances of turning high-intent leads into clients.

LeadCenter’s Rapid Lead Response feature lets you automate follow-ups as soon as a lead interacts with your content, ensuring you’re always the first to respond. You can send both emails and text follow-ups based on the lead’s engagement.

Subject: Join Us for an Exclusive Financial Planning Webinar, [First Name]

Body:

Hi [First Name],

We’re excited to invite you to our upcoming exclusive webinar on [Topic], where we’ll dive deep into the most effective financial planning strategies for [specific group, e.g., retirees, business owners, young professionals].

We’d love to have you join us!

[Register Now for the Webinar]

Even a perfectly crafted email won’t convert if it lands in the spam folder or bounces back. Ensuring high email deliverability is key to getting your emails seen. Verifying email addresses and avoiding spammy words will help reduce bounces and improve the likelihood of landing in the inbox.

LeadCenter helps ensure high deliverability by setting up and managing DKIM, and DMARC records for your domain. Additionally, LeadCenter’s email verification feature allows you to remove invalid or inactive email addresses from your list, reducing bounce rates and improving sender reputation.

Email compliance is critical in avoiding penalties and maintaining trust with your audience. The CAN-SPAM Act requires that your emails include clear opt-out options, avoid misleading subject lines, and include your business’s physical address.

LeadCenter makes compliance easy by automatically adding unsubscribe links to your emails and ensuring your campaigns follow CAN-SPAM requirements. The platform tracks opt-outs to ensure that you don’t accidentally email someone who has unsubscribed.

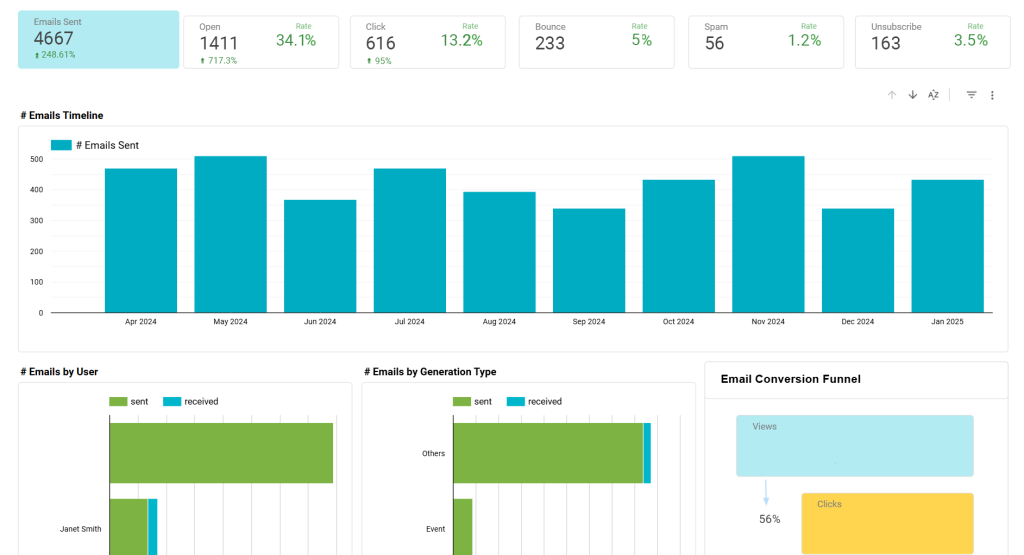

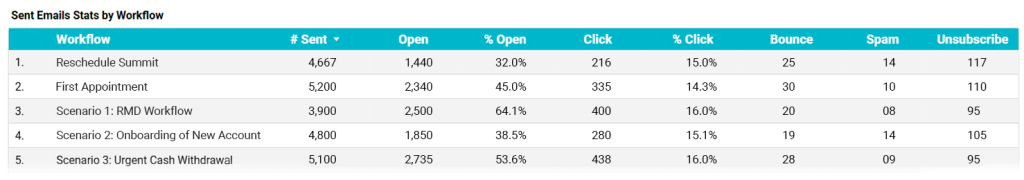

Tracking email performance is key to optimizing future campaigns. By analyzing data like open rates, click-through rates, and conversions, you can see what’s working and improve your strategy for future emails.

LeadCenter provides detailed reporting dashboards that allow you to track open rates, click-through rates, and conversions. You can easily run tests and gather data on what works best for your audience, ensuring that your campaigns continuously improve.

Ready to see how LeadCenter can transform your email marketing strategy? Built specifically for financial advisors, LeadCenter offers powerful features that go beyond generic tools like Mailchimp, Constant Contact, or Drip.

Here’s why financial advisors choose LeadCenter:

LeadCenter’s combination of email, text, event management, and appointment scheduling ensures you’re equipped to engage and convert leads across every stage of the journey.

Ready to streamline your marketing and lead management?