All Production (Issued, Pending, and Cancelled)

Reporting and analytics help you understand your business operations and enable you to view key performance indicators (KPIs). These KPIs show you different aspects of your financial advisory firm by compiling data into comprehensive reports. One of these reports is the All Production (Issued, Pending, and Cancelled) report which displays all the client accounts information and presents growth-driven statistics.

Access the All Production report

Follow the steps given below to access the All Production report:

- Log into your LeadCenter account.

- Click on Reports in the left navigation sidebar.

- Navigate to Production Reports and select All Production (Issued, Pending, and Cancelled)

- That’s all!

Dashboard components

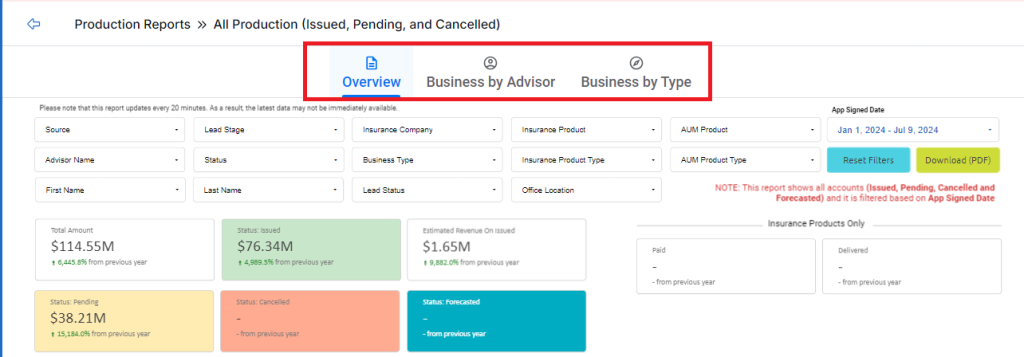

Upon accessing this report, you’ll see three tabs on top. Each tab provides a different kind of report. These tabs are:

- Overview

- Business by Advisor

- Business by Type

Common components

The common components of each tab include:

- Filters (on top)

- Metrics

- Tabular representation of List of Accounts (at the bottom)

Filters

You’ll see the filters on top of the screen. You can click on the required filter dropdown to narrow down your search.

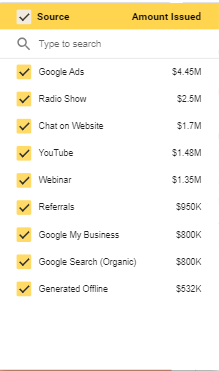

Source

Click on this dropdown to see the different channels your leads are originating from.

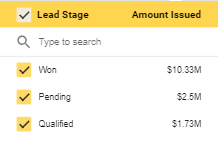

Lead Stage

Click on the dropdown to select the stage of a lead’s journey. You can customize the lead stages as required.

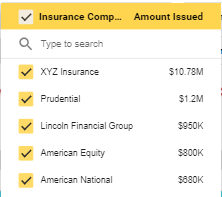

Insurance Company

Click on this dropdown to select the accounts for a specific insurance company. You can select the required insurance company from a list of companies.

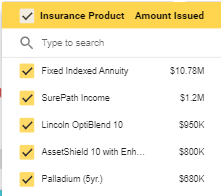

Insurance Product

Click on the dropdown to see the accounts for a specific insurance product.

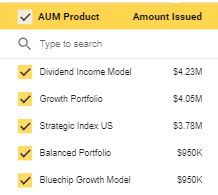

AUM Product

Click on the dropdown to see the accounts for a specific AUM product.

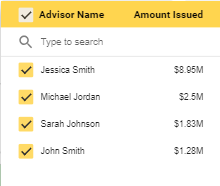

Advisor Name

Click on this dropdown to select the writing advisor managing the accounts.

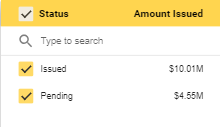

Status

Click on the dropdown to select the status of the account. For example, issued or pending.

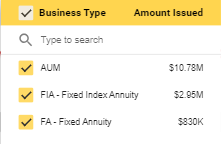

Business Type

This dropdown allows you to select the account type. For example, AUM or annuity.

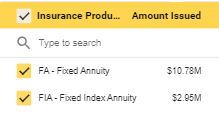

Insurance Product Type

Click on the dropdown to choose the insurance product type.

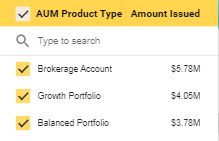

AUM Product Type

Click on the dropdown to choose the insurance product type.

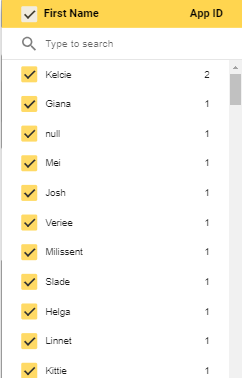

First Name

Use this filter to search by the first name.

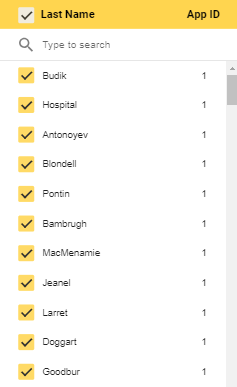

Last Name

Use this filter to search by last name.

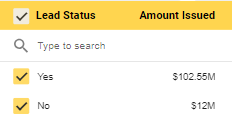

Lead Status

Click on the drop-down menu to see lead status.

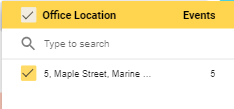

Office Location

Click on the drop-down menu to see the location of the office.

Metrics

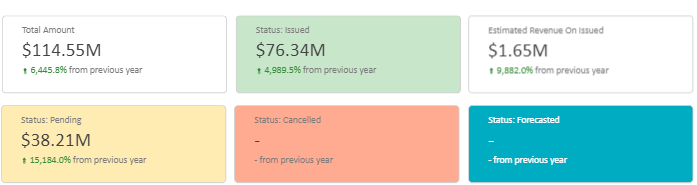

After the filters, you can see the following metrics at-a-glance:

- Total Amount

- Status: Issued

- Estimated Revenue On Issued

- Status: Pending

- Status: Cancelled

- Status: Forecasted

Here’s a brief description of these metrics:

Total Amount

This is the total amount that your company is handling for the clients.

Status: Issued

The amount that has been issued to your company.

Estimated Revenue On Issued

The estimated revenue calculate from the issued amount.

Status: Pending

The amount that is yet to be received.

Status: Cancelled

The number of accounts that were cancelled.

Status: Forecasted

Tabular representation of List of Accounts

By the end of each report, you’ll find a table with different columns each representing a different element of the client accounts.

- Contact Link ID: The clickable lead ID to take you to the lead details page in LeadCenter.

- Contract Number: The unique number assigned to a contract.

- Client Name: The name of the client.

- Advisor Name: The name of the writing advisor taking the lead on this account.

- Business Type: The type of account selected by the client. For example, fixed annuity or AUM.

- Insurance Company: The name of the insurance company.

- Insurance Product: The name of the insurance product.

- Aum Product: The name of the AUM product.

- App Signed Date: The date when the contract was signed.

- Account Issued Date: The date when the investable amount was issued to the account.

- Status: The status of the account. For example, issued or pending.

- Lead City: The name of the city your lead is from.

- Lead State: The open state means that the lead is still in the processing stage while the closed state means that the lead is coveted or lost.

- Forecasted Date:

- Submitted Date:

- Ready Date:

- Received Date:

- Amount Issued: The total investable amount issued by the client.

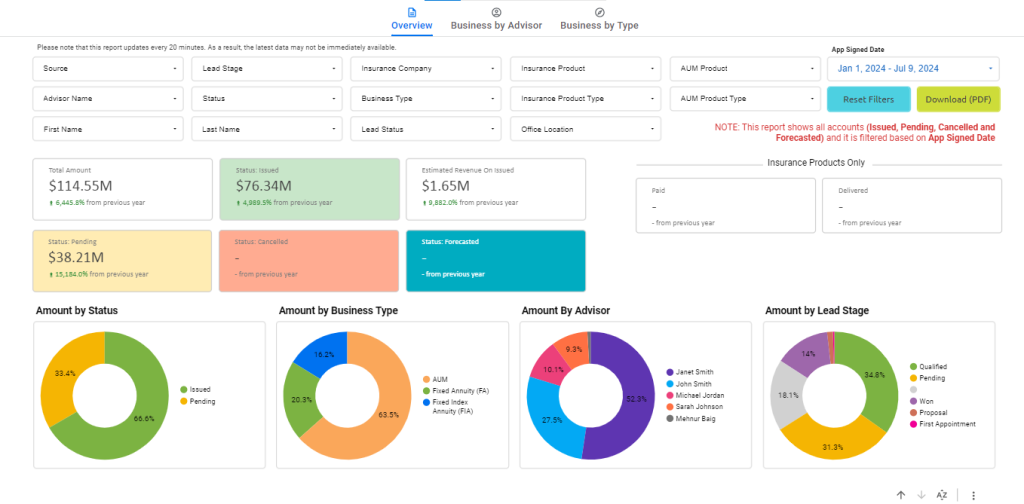

Overview tab

You can switch between tabs to see the components specific to each tab. Let’s see the components of the Overview report:

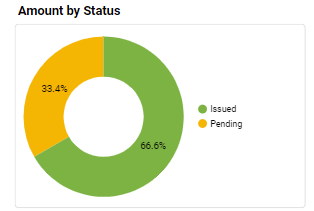

Pie graphs

You’ll see pie graphs displaying different business information in percentages.

Amount by Status

This graph shows the percentage of accounts in issued, pending, cancelled, and closed status.

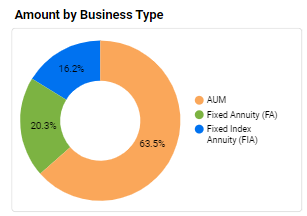

Amount by Business Type

This graph represents the percentage of business types associated with client accounts. For example, your company is handling 60% AUM, 20% fixed annuity, and 20% fixed index annuity accounts.

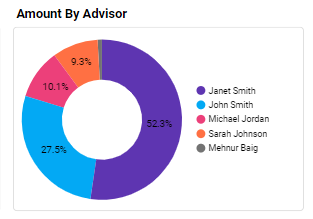

Amount by Advisor

This graph shows advisors’ contribution to managing clients’ accounts.

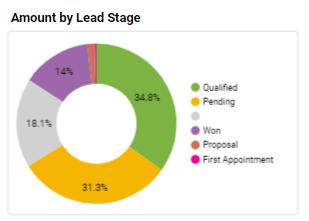

Amount by Lead Stage

This graph shows the stages of a lead’s journey. For example, 30% of your leads are pending, 30% are qualified, and 40% are won.

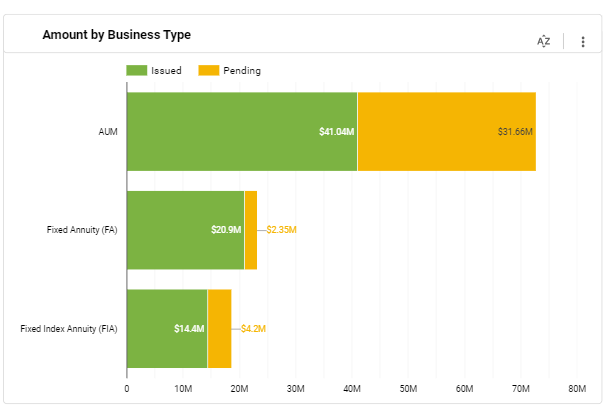

Bar graphs

You’ll see bar graphs that represent the amount issued and pending by:

- Year

- Quarter

- Advisor

- Business Type

Amounts Timeline

This graph represents the amount issued, pending, cancelled, and closed by month, quarter, and year.

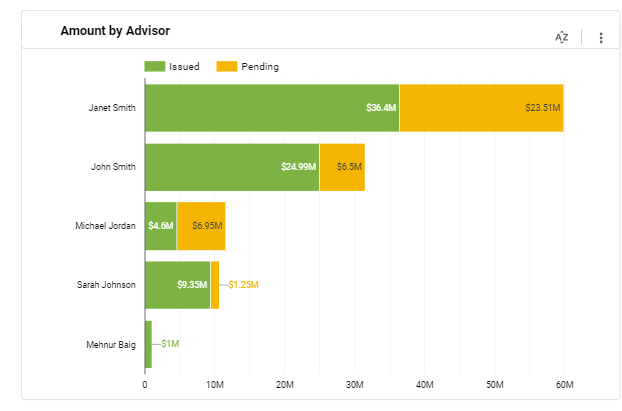

Amount by Advisor

This graph shows the amount issued and pending by the advisor handling that account.

Amount by Business Type

This graph shows the issued, pending, cancelled, and closed accounts for fixed annuities, fixed index annuities, and AUM.

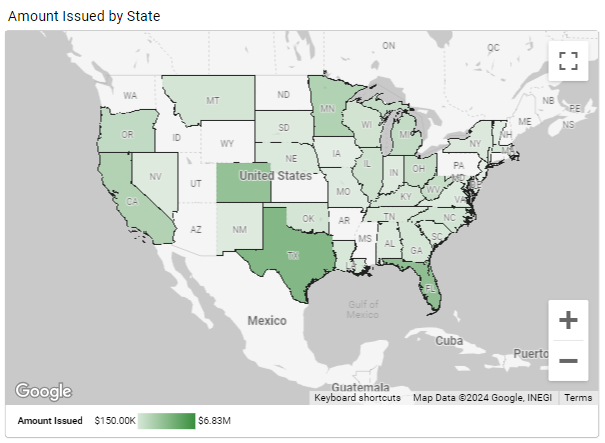

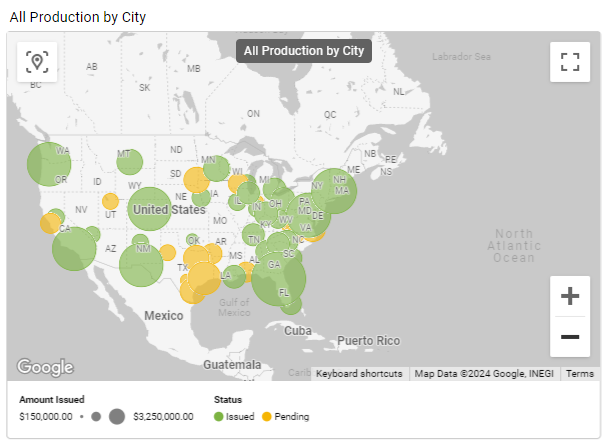

Maps

You can also get a holistic view of the production reports by state and city on the maps included within this report.

Amount Issued by State

All Production by City

Business by Advisor tab

Switch to this tab and you’ll find tables showcasing the business metrics associated with each advisor.

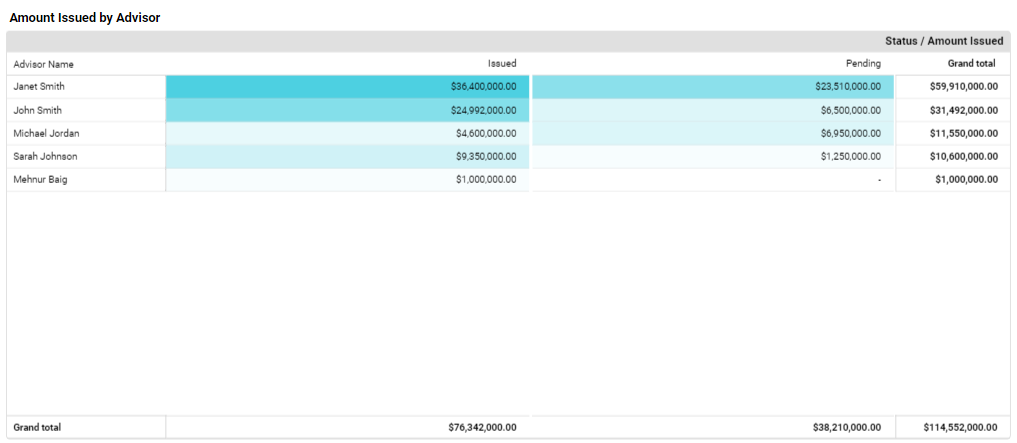

Tabular representation of Amount Issued by Advisor

This table shows the total amount each advisor is managing. You can see these columns:

- Advisor Name: The name of the writing advisor managing the amount.

- Issued: The actual amount issued by the client.

- Pending: The amount that still needs to be paid by the client.

- Grand Total: The sum of issued and pending amounts.

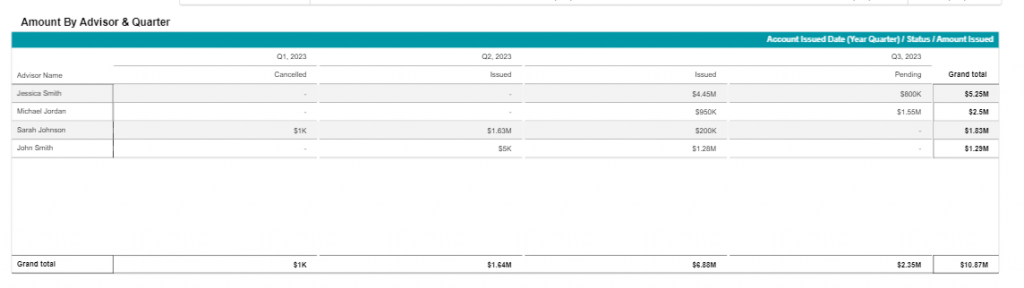

Tabular representation of Amount By Advisor & Quarter

This table further elaborates on the total amount each advisor is handling per quarter. You can see the same columns as above, the only difference is that these columns are grouped by quarters.

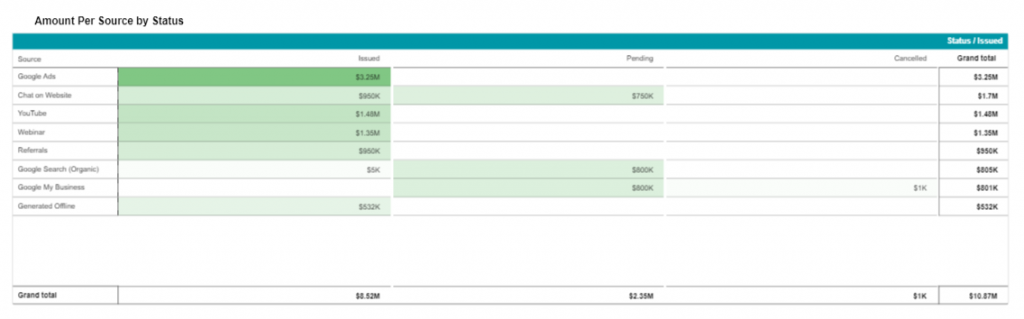

Tabular representation of Amount Per Source by Status

This table showcases the main channels that your leads are generated from. The columns here represent the leads that come from certain sources and are now clients with accounts. This enables you to view the channels that bring the highest money flux.

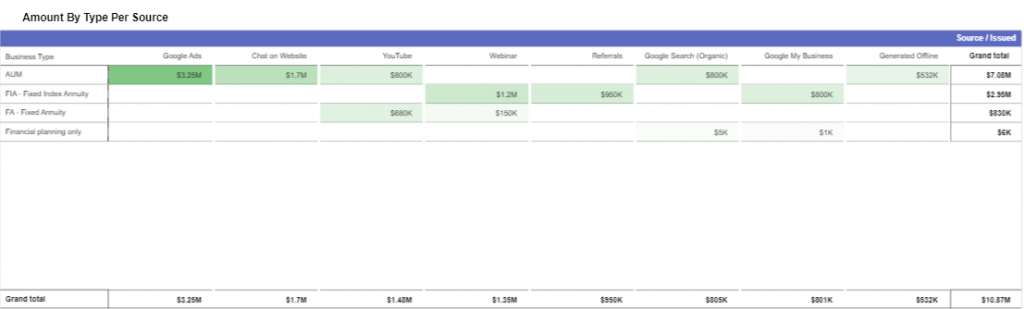

Business by Type tab

This is the default tab that you’ll see when you access the All Production report. This is specifically for the business owners to view the insurance/AUM products and the amount associated with each one.

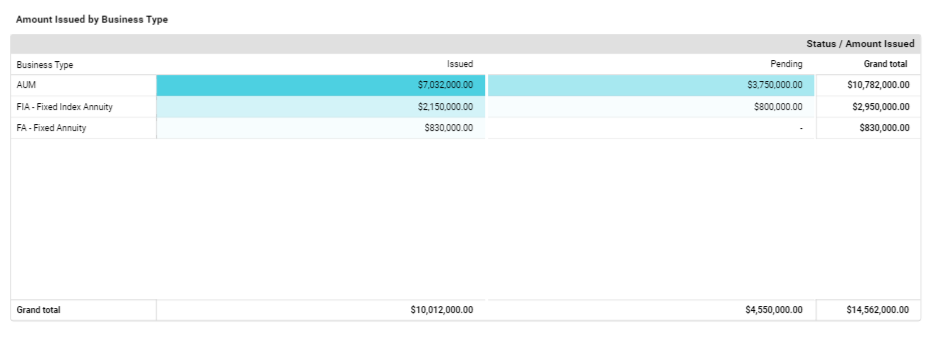

Tabular representation of Amount Issued by Business Type

This table displays insurance/AUM products and the amount each product is bringing in.

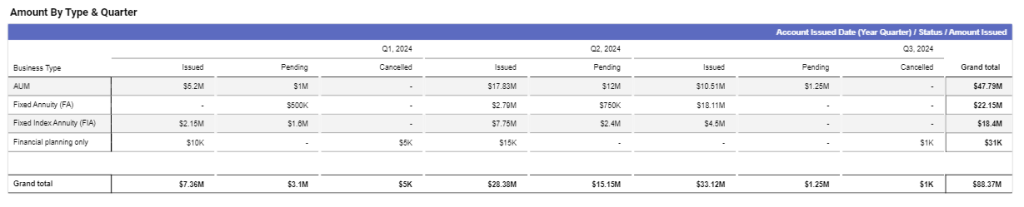

Tabular representation of Amount By Type & Quarter

This table represents the amount issued for products, and groups it by each quarter.

Tabular representation of Amount By Type Per Source

This table displays all the products in the first column and dedicates all other columns to the sources the leads come from. This enables you to view the sources which bring the highest flux of money.